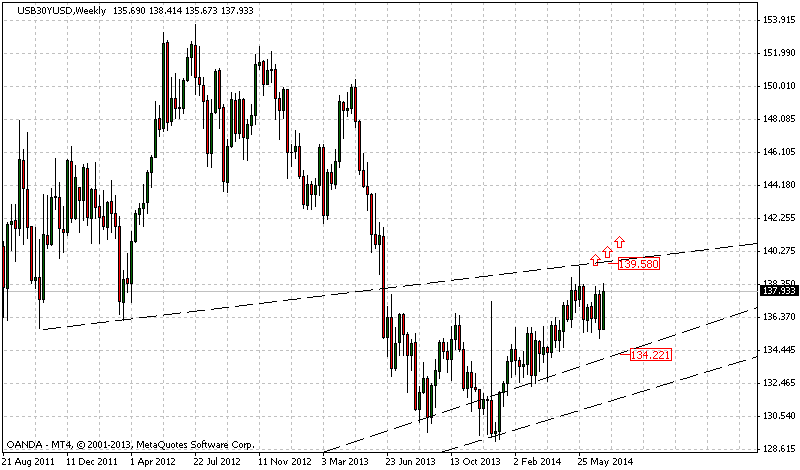

Key decision drivers - long term trendline support bounce , Weekly stat arb indicating upside breakout potential .

Daily close above 138.50 and a weekly close above 139.50 does the job. Overall the strategy can be fine tuned by looking out for long setups in 135.50 region and stops below 134 to target 138.50 at first and then larger targets like 141.50.

30 Yr bonds have been finding decent enough support in 135.00/50 zone for the last 2-3 months hence a stops below 134.00 is ideal and justifies the technical setup.

On a fundamental perspective my Dax Index model has shows signs of exhaustion along with few other equity indices like Dow, Bovespa, BSE which may imply a consolidatory to slightly corrective (lower) phase in equities sending bonds higher.

Overall my directional view on 30 yr bonds for the next 2 months is Bullish .

No comments:

Post a Comment