On 11th July, I highlighted the fact that US30 yr Bonds will rally and target 141.50. Further a bearish equity note indicating equity indicies especially DAX ..

Since the note was posted US 30 Yr traded 141.50 and DAX corrected lower by 10% . My weekly and monthly model forecasts have now indicated a very strong rally in Equities into the year end especially DAX to trade 10500.

The US conterparts are already trading at life time highs whereas DAX is lagging. ECB easing is likely to boost liquidity amongst European banks and support growth in coming quarters. Overall growth in developed nations especially US & UK will have a positive spillover effect on Eurozone sooner or later. Hence the catchup theory calls for a Long DAX on dips strategy targeting 10500 by year end.

If you are a chartist and follow charts on a monthly and quaterly scale then the current bounce from 8900 level on Dax will appeal you.

best of luck traders.

Wednesday, August 27, 2014

Thursday, August 21, 2014

AUD & JPY crosses risks lie to the upside breakout.

Buy AUDCAD 1.0180 Stops 1% for 1.0300

Buy AUDJPY 96.00 stops below 95.00 depending on your risk appetite as the pair heads to 99.50

Bullish USDJPY forecasts from my weekly model with initial target 104.70/105.00 and depending on the monthly close in August potential for 107. i.e if Monthly close in August > 105 then very good potential for 107.

I am relatively bullish AUD and bearish JPY hence AUD/JPY does the job for me.

Buy AUDJPY 96.00 stops below 95.00 depending on your risk appetite as the pair heads to 99.50

Bullish USDJPY forecasts from my weekly model with initial target 104.70/105.00 and depending on the monthly close in August potential for 107. i.e if Monthly close in August > 105 then very good potential for 107.

I am relatively bullish AUD and bearish JPY hence AUD/JPY does the job for me.

Friday, July 11, 2014

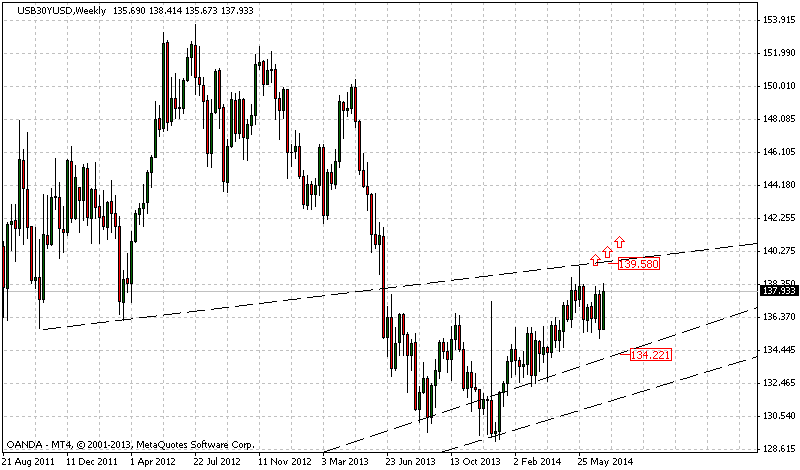

30 Yr US Bonds upside breakout risks !

Timespan for strategy validity based on in-house model - 2 Months.

Key decision drivers - long term trendline support bounce , Weekly stat arb indicating upside breakout potential .

Daily close above 138.50 and a weekly close above 139.50 does the job. Overall the strategy can be fine tuned by looking out for long setups in 135.50 region and stops below 134 to target 138.50 at first and then larger targets like 141.50.

30 Yr bonds have been finding decent enough support in 135.00/50 zone for the last 2-3 months hence a stops below 134.00 is ideal and justifies the technical setup.

On a fundamental perspective my Dax Index model has shows signs of exhaustion along with few other equity indices like Dow, Bovespa, BSE which may imply a consolidatory to slightly corrective (lower) phase in equities sending bonds higher.

Overall my directional view on 30 yr bonds for the next 2 months is Bullish .

Key decision drivers - long term trendline support bounce , Weekly stat arb indicating upside breakout potential .

Daily close above 138.50 and a weekly close above 139.50 does the job. Overall the strategy can be fine tuned by looking out for long setups in 135.50 region and stops below 134 to target 138.50 at first and then larger targets like 141.50.

30 Yr bonds have been finding decent enough support in 135.00/50 zone for the last 2-3 months hence a stops below 134.00 is ideal and justifies the technical setup.

On a fundamental perspective my Dax Index model has shows signs of exhaustion along with few other equity indices like Dow, Bovespa, BSE which may imply a consolidatory to slightly corrective (lower) phase in equities sending bonds higher.

Overall my directional view on 30 yr bonds for the next 2 months is Bullish .

RV Trade Short ZAR against a basket of INR & MXN - Reform Trade

Last few quarters have been extraordinary for EMFX especially countries running the risk of higher current accounts(deficits), political risks.

Long MXNZAR @.8100 stop 0.7900 for 0.8500

Long INRZAR @ 0.1755 stop 0.1710 for 0.1810 and 0.1900

I like to call this the reform trade. The expectations of investors from EM governments to push in new reforms has been higher than ever. Firstly it was Mexico with its oil reforms and recently expectations from Modi's Indian government. The recent trend has been, the inflows to buy Indian equities and bonds with the 'expectation' of change and implementations of new reforms. A similar trend can be noticed in Indonesian equities with the expectations of new government and possible reforms. Later this year investors expectations from Brazil should reflect in Bovespa and BRL.

On a relative basis South Africa is severely lagging in terms of new reforms to kick start the economy or increase investor confidence. SARB is relatively dovish on its monetary stance as growth has fallen. The current account deficit remains a concern when compared to likes of Mexico or even India which has managed to reduce it remarkably.

There is a carry potential on Long INRZAR whereas a slightly negative carry on Long MXNZAR.

The chart above is INR/ZAR Monthlies and it is evident that the pair has found support on the long term support trend line at 0.1750 after consolidating for approximately 5 months and now heads higher to top of the range trend line resistance of 0.1920. My in house models do agree with the setup which is a plus.

The chart below is MXNZAR monthlies. 0.8000 has been a multi year resistance line which has been tested aggressively in 2008-09' but failed to trade above. Last quarter of 2013 the pair finally closed above 0.8000 and since then has been finding support at 0.8000. I think there is potential for 0.8500 for this trade which is the topline resitance. Again my models do agree with the forecast. Overall there lies plenty of scope trading the big range 0.7500-0.8500 depending on the risk profile one has and how he perceives the incoming macro data.

Long MXNZAR @.8100 stop 0.7900 for 0.8500

Long INRZAR @ 0.1755 stop 0.1710 for 0.1810 and 0.1900

I like to call this the reform trade. The expectations of investors from EM governments to push in new reforms has been higher than ever. Firstly it was Mexico with its oil reforms and recently expectations from Modi's Indian government. The recent trend has been, the inflows to buy Indian equities and bonds with the 'expectation' of change and implementations of new reforms. A similar trend can be noticed in Indonesian equities with the expectations of new government and possible reforms. Later this year investors expectations from Brazil should reflect in Bovespa and BRL.

On a relative basis South Africa is severely lagging in terms of new reforms to kick start the economy or increase investor confidence. SARB is relatively dovish on its monetary stance as growth has fallen. The current account deficit remains a concern when compared to likes of Mexico or even India which has managed to reduce it remarkably.

There is a carry potential on Long INRZAR whereas a slightly negative carry on Long MXNZAR.

The chart above is INR/ZAR Monthlies and it is evident that the pair has found support on the long term support trend line at 0.1750 after consolidating for approximately 5 months and now heads higher to top of the range trend line resistance of 0.1920. My in house models do agree with the setup which is a plus.

The chart below is MXNZAR monthlies. 0.8000 has been a multi year resistance line which has been tested aggressively in 2008-09' but failed to trade above. Last quarter of 2013 the pair finally closed above 0.8000 and since then has been finding support at 0.8000. I think there is potential for 0.8500 for this trade which is the topline resitance. Again my models do agree with the forecast. Overall there lies plenty of scope trading the big range 0.7500-0.8500 depending on the risk profile one has and how he perceives the incoming macro data.

Tuesday, July 1, 2014

EMFX Currency Charts- Risk lie to upside short term !

Cautious on EMFX short term possibly till end of July. If you are following my posts since May 2014 you will notice a short bias in emerging market currencies especially INR (post election).

The following charts are long term however the daily formations and intra-day price action off this major trendlines should not be ignored! Also notable three day bank holiday coming in the US so I would expect the vols to kick in next week or so. Time to buckle up the seat belts..

The following charts are long term however the daily formations and intra-day price action off this major trendlines should not be ignored! Also notable three day bank holiday coming in the US so I would expect the vols to kick in next week or so. Time to buckle up the seat belts..

Daily 10YR TRY Yields basing out at 8.50 support.

Monday, June 23, 2014

RV Trade: Bullish HUF/PLN

Ref Rate 100HUF= 1 PLN

Long term charts in HUF/PLN indicate a very good medium term opportunity for longs in 1.34-1.3550 region depending on what sort of risk profile you have . The base of the long term trendline is at 1.3400 , I believe the support will continue attractive relative value traders and there is good potential for 1.4200 in 6 months time.

>First of all my quant models compliment the current growth figures in Hungary which is now in the league of fast growing economies in (CEE region).

>Hungary's current account surplus will continue supporting the Forint relative to Poland which runs a deficit.

>Both CB's i.e MNB and NBP have initiated series of small rate cuts citing deflationary risks however the NBP seems relatively more dovish than MNB in its approach to tackle deflationary threats.

Risks:

Both Hungary and Poland have picked up momentum in terms of growth this year. The events which will dictate the pair are as below:

>Change in monetary stance by CB's

> Inflation starting to pick up.

Best of luck traders!

PS: Not to confuse the Bullish HUF/PLN with the earlier posted Bullish USD/HUF . Different strategy one is RV other one is Directional..

Moreover the USD/HUF made a high print of 227.30 and had gained almost 2.75% since my post on 22nd May (221.50)

Friday, June 20, 2014

Silver/Gold Ratio an interesting medium term trade for 2014 !

Ref: 100oz Silver = oz Gold

XAG/XAU has been testing a long term trendline since 90's and has now made an interesting reversal pattern which I like to call it as 'Triangular Reversal' at a major trend line support. In other words Silver is heading for a major reversal and is more likely to revert back to 1.75 with a strong possibility of 1.90 on a longer term basis against Gold. My analysis is based on few stat arb models which I have run at my end and traditional methods like the one posted here. In short Long XAG/XAU ref rate 1.58 has a potential to gain 15-20% in about years time. Fundamental factors could play a role as US growth gathers momentum along with other western countries like UK . ( Not to mention the positive spillover effects of US growth on EM countries.)

Medium-Long Term Play Guys

Best of luck traders !

XAG/XAU has been testing a long term trendline since 90's and has now made an interesting reversal pattern which I like to call it as 'Triangular Reversal' at a major trend line support. In other words Silver is heading for a major reversal and is more likely to revert back to 1.75 with a strong possibility of 1.90 on a longer term basis against Gold. My analysis is based on few stat arb models which I have run at my end and traditional methods like the one posted here. In short Long XAG/XAU ref rate 1.58 has a potential to gain 15-20% in about years time. Fundamental factors could play a role as US growth gathers momentum along with other western countries like UK . ( Not to mention the positive spillover effects of US growth on EM countries.)

Medium-Long Term Play Guys

Best of luck traders !

Thursday, May 22, 2014

USDHUF AT RISK ?

Guys if you trade USD/HUF then you gotta pay attention to latest formations on M,W and D charts. My weekly stat arb is slightly skewed higher and supports the current bounce on the monthly trendline. I think there is a strong possibility of 230 and I am closely watching the flag structure on dailies along with the support on the daily trendline at 221.

Good luck!

Tuesday, May 13, 2014

Indian elections USDINR thoughts!

Just a word of caution here for my followers from India. Updating my thoughts as have got several requests with regards to USDINR.

First things first, my monthly and weekly stat arb have realigned for a slightly bullish forecasts and project a gradual move higher valid for next 3-4 months. Technically 59 is now key and should remain pivotal for next couple of months . I rarely trade against my model forecast hence I am more likely to stay away from INR shorts due to high carry but for corp players levels like 59 and 56( very strong , that thou if we see this) are good levels to own Dollars I believe.

INR traders and FDI's have already positioned for BJP victory and now what matters is the majority with which BJP wins. The higher majority is likely to give an immediate push to USDINR lower and a slim majority will result in profit taking sales to emerge.

As per model forecast a 4-5% upward correction is likely from post election Monday USDINR daily close price.

best of luck..

Wednesday, February 19, 2014

Pre-FOMC mins Stat Arb Model Forecasts

Hello Traders,

Going into FOMC minutes my daily USDZAR, USDTRY, EURTRY AND DOLLAR INDEX models are indicating a slight bullish forecast. This forecast is valid for next 5-7 working days and I am expecting Dollar to pick up momentum on upside for this week going into mid-next week.(short term).

Also notable Kiwi daily stat arb has indicated exhaustion in uptrend and correction lower is due. Out of all the forecasts I like the USDZAR LONG trade 'smalls' at 10.90 stops below 10.80 for 11.20 types.

On the majors, few other pairs like EURUSD,USDCHF have indicated slight exhaustion in trend and support a mild Dollar rally. Will be surprised any major downside in Dollar today.

best of luck guys

Monday, February 10, 2014

INR UPDATE

With regards to the Long EUR/INR issued on 13th Nov, think time is ripe to close it as the position is not feasible owing to cost of carry which has costed almost 3% even though the price reference level is almost same since Nov 13'.

Some of the drawbacks of shorting high yielders eh !

will keep updated if any other interesting opportunities come up.

Thursday, January 30, 2014

A Contrarian Trader's 2 pips on EMFX

As a starters EUR/HUF has traded 310 as highlighted in my Nov 13 issue (Dec15 post) . Even if you managed to pick EUR/HUF on Dec15 you would have been sitting comfortable 4% higher as of now. So basically job done on EUR/TRY and EUR/HUF and the last pair which is still lagging is INR . I am going to stop mentioning how TRY is getting hammered day by day as its pointless. Twitter will do that for you!

Lets focus on TCMB, I expressed concerns about how the bank may hesitate to raise rates which could put their credibility to threat. This week they did it but as you would expect market saw this signs of desperation and weakness and local Turkish traders saw this opportunity to bank as much Dollars they could. Then came SARB raising rates on ZAR. At this very point I was not aware they had a policy meeting until one of my good trader mate actually made me aware. The very first words which came out of my mouth were " I hope SARB doesn't do anything absurd by raising rates" They actually raised rates and the price action post rate hike was horrible.

Personally think emergency rate hikes do not pan out well when slow growth,debt issues and political risks are looming in near term. Take an example of the brave attempt taken by MNB in Oct 2008' by raising 300bp on Forint. Post rate hike EUR/HUF lost approx 10% and in the next few months carried with the overall bullish trend and made new highs erasing all the gains post rate hike. Of course some may argue it was a totally different situation, but does it really matter ? Looking at how market has reacted to ZAR and TRY it is very similar to how market reacted to HUF in the past. Infact in the case of USD/ZAR it made a new high post rate hike right away. Charts below Weekly EURHUF, 4H EUTRY and 1H USDZAR

For now I have shifted my focus on Scandies and CE4 and by the way HUF traders were clueless yesterday. Again a classic example of fundamentals and sentiment reflect in charts if interpreted correctly.

Best of luck traders!

Lets focus on TCMB, I expressed concerns about how the bank may hesitate to raise rates which could put their credibility to threat. This week they did it but as you would expect market saw this signs of desperation and weakness and local Turkish traders saw this opportunity to bank as much Dollars they could. Then came SARB raising rates on ZAR. At this very point I was not aware they had a policy meeting until one of my good trader mate actually made me aware. The very first words which came out of my mouth were " I hope SARB doesn't do anything absurd by raising rates" They actually raised rates and the price action post rate hike was horrible.

Personally think emergency rate hikes do not pan out well when slow growth,debt issues and political risks are looming in near term. Take an example of the brave attempt taken by MNB in Oct 2008' by raising 300bp on Forint. Post rate hike EUR/HUF lost approx 10% and in the next few months carried with the overall bullish trend and made new highs erasing all the gains post rate hike. Of course some may argue it was a totally different situation, but does it really matter ? Looking at how market has reacted to ZAR and TRY it is very similar to how market reacted to HUF in the past. Infact in the case of USD/ZAR it made a new high post rate hike right away. Charts below Weekly EURHUF, 4H EUTRY and 1H USDZAR

For now I have shifted my focus on Scandies and CE4 and by the way HUF traders were clueless yesterday. Again a classic example of fundamentals and sentiment reflect in charts if interpreted correctly.

Best of luck traders!

Monday, January 13, 2014

DX outlook 2014

Just finished creating my 2014 outlook for Dollar . The report is bearish Dollar at least going into Q1 and Q2 and is path dependent into Q3.

Also added a bullish AUD cross note in my report and I expect AUD crosses to remain bid or find interest atleast till Feb end in Q1. This is inline with my tweet on 6th Jan where I highlighted AUDUSD,AUDCNY,AUDCAD AND AUDNZD weekly stat arb is exhaused or in other words Aussie selling is overdone and expect short covering in AUD.

I will publish my report here when time is ripe.

Also added a bullish AUD cross note in my report and I expect AUD crosses to remain bid or find interest atleast till Feb end in Q1. This is inline with my tweet on 6th Jan where I highlighted AUDUSD,AUDCNY,AUDCAD AND AUDNZD weekly stat arb is exhaused or in other words Aussie selling is overdone and expect short covering in AUD.

I will publish my report here when time is ripe.

Subscribe to:

Comments (Atom)